Attorney at Law Real Estate Broker

tel: (404) 419-3574

e: office@haprichardson.com

950 East Paces Ferry Road NE

Suite 1555

Atlanta, GA 30326

Our goal is to reduce your property tax bill.

The issue in a property tax appeal case is the county's opinion of the fair market value of your property.

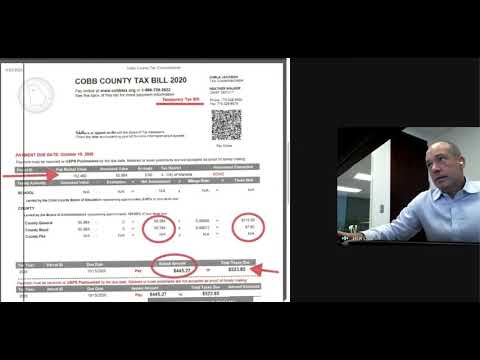

The tax bill is comprised of the fair market value multiplied by the millage rate.

Therefore, if we can reduce the fair market value then we reduce your property tax bill proportionally.

Property Tax Attorney

Contact me today!

Scope of Service

Each year I file about 1,000 property tax appeals in over 40 different Georgia Counties

We handle the entire property tax appeal process:

What is a temporary tax bill?

Property Tax Podcasts

Hap Teaches Continuing Education

"An Overview of the Georgia Property Tax System"

Approved for 3 hours of continuing education for CPAs and Realtors by the Georgia Real Estate Commission and NASBA

Featured Neighborhood: Old Fourth Ward

Old Fourth Ward is one of Atlanta's oldest neighborhoods. The recent developments in this neighborhood are incredible.

Click on these links to learn more about this area:

"Hap handled the property tax appeal for my primary residence in 2016 and crushed it. I highly recommend him and his team!"

★★★★★

5-Star Google Review

My Clients

Deadline to File for Homestead Exemption is April 1, 2022

Relevant Links of Interest